Chromalloy Mexicali Facility at PIMSA I

Mexicali, Baja California, Mexico

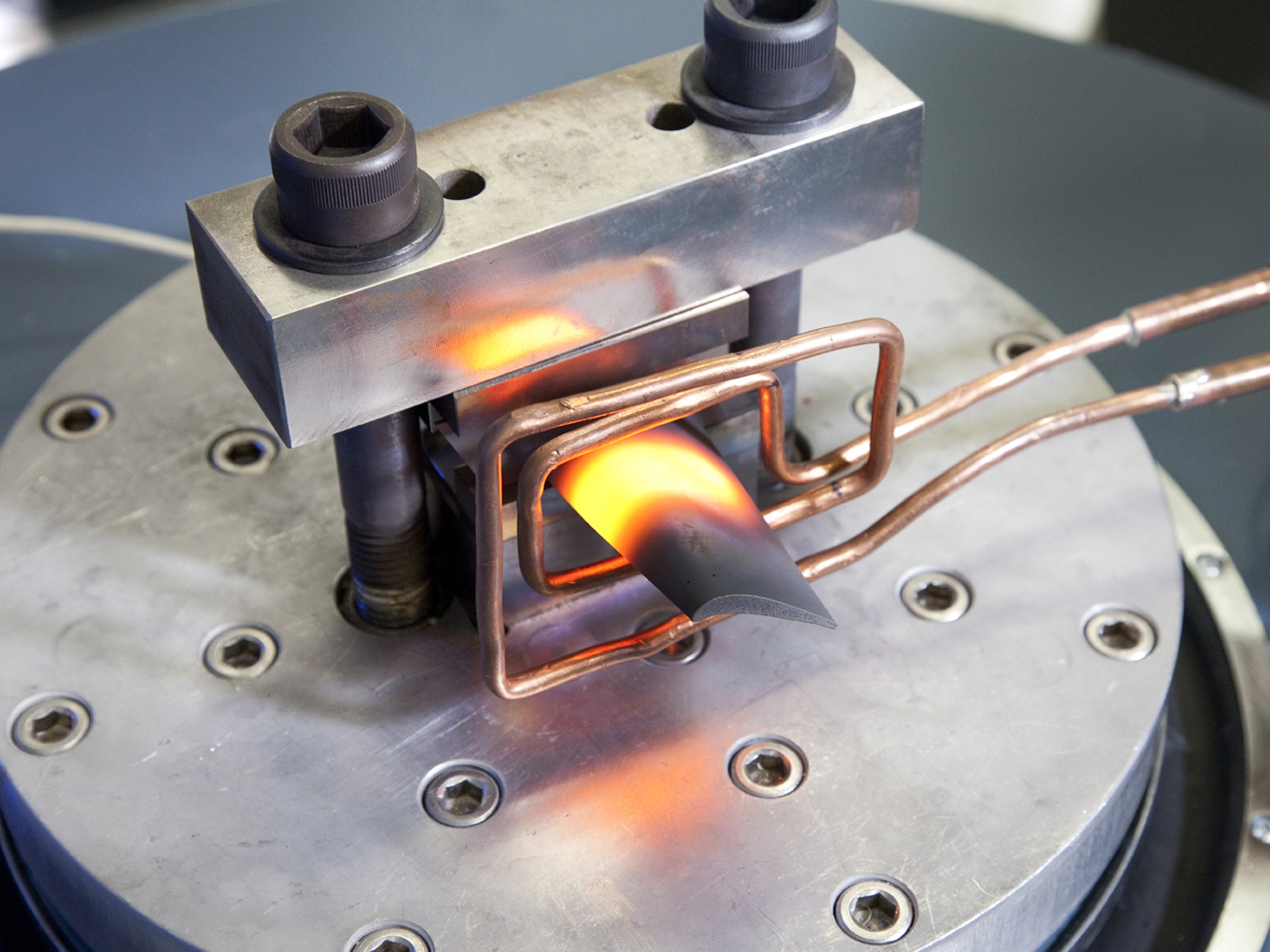

During the last months of 2015, three members of the engineering staff of Chromalloy Mexicali, an aerospace company provider of repair solutions and components manufacturing for aircraft engines, located at PIMSA; received a patent by the US Patent and Trademark Office, after having invented a repair for a turbine engine component of commercial aircraft, offering a new and innovative repair solution in each of the parts, materials, services and customer care.

The team worked for several months to design, test, retest and validate the repair. Driven by the challenges of the individual needs of Chromalloy’s customers; Xuan Nguyen-Dinh, Roberto Flores Sandoval and Ben Blumanstock describe the patent as “providing the process to restore displaced or worn parts on a segment of the turbine vanes.”

The job consisted in replicate an existing manual OEM repair so they could identify their deficits and opportunities for improvement and ultimately design a new repair that exceeds specifications and performance of the manual repair.

Source: SIGLO 21

Head Count, Growth Projections, Utilities Availability, Operation Costs, General ROI and profitability, Supplier Quality. Confidential Reports.

supplier management, human resources and talent procurement and relocation.

Industrial Monthly Report, Snapshot, Real Estate Availability.

Interviewing, Industrial Talks, Support Local Business Development Initiatives.

Location Strategy, Market Analysis, Human resources and talent retention, Supplier Development and soft-landing.

Xavier Rivas

VP Business Development

xavier@pimsa.com.mx

+52(686) 243 7833

Constellation Brands’ third-quarter profits and sales beat estimates Thursday, as the company announced it will spent more than $1.5 billion to expand its Mexican beer production.

Net sales rose 6 percent to $1.64 billion for the quarter ending Nov. 30, with beer sales up 8 percent, attributed largely to volume growth. Constellation President and CEO Rob Sands noted the “accelerating momentum” of its Corona Extra and Modelo Especial brands. The company also finalized the purchase last quarter of craft beer maker Ballast Point. Wine and spirits net sales grew a steady 3 percent.

The Victor-based company reported net income of nearly $271 million, or $1.33 a share, up 21 percent year-over-year.

For Constellation, it was the fourth consecutive year having one of the best-performing stocks in the S&P 500 Consumer Staples Index. Sands spoke of the company’s “incredible momentum and strong prospects for future growth.”

“We are making smart investments now to ensure we have the capacity, quality control and flexibility to help us meet expected demand for our iconic beer brands well into the future,” Sands said.

A new, $1.5 billion state-of-the-art brewery, to be located in Mexicali, Mexico, should be completed in four or five years. Initial production capacity is pinned at 10 million hectoliters with potential future expansion to 20 million hectoliters. The first 5 million hectoliters should be online in late 2019. Compare that to the company’s brewery in Nava, Mexico, which currently has a 15 million hectoliter capacity, should reach 20 million by June, and grow to 25 million by summer 2017. An additional $250 million, 2.5 million-hectoliter expansion, announced Thursday, will bring capacity there to 27.5 million hectoliters by early 2018.

The Mexicali location’s proximity to California is ideal, Sands said, as the Golden State is Constellation’s largest beer market.

Growth of the U.S. beer market has been steady and, Sands said, should continue into the future. Most of Constellation’s brands are seeing growth rates exceeding those of competitors, he said, attributing that to marketing, the Corona can format and new markets.

Source: Democrat and Chronicle

Furukawa Mexico

Mexicali, Baja California, Mexico

Furukawa México is now looking for suppliers of reel to reel plating for their Mexicali Manufacturing Facility at PIMSA.

This a unique opportunity to those local, world manufacturers.

As you can see on the following presentation, Furukawa will continue to grow, we are looking for suppliers to be on a 300 mile proximity:

Furukawa Automotive Presentation

Should your company be interested, please contact Cesar Castaneda, Purchasing Team Leader, e-mail: ccastaneda@americanfurukawa.com

There are other Mexicali manufacturers in search of suppliers.

You can also contact Cesar Ponce, Coordinator of PIMSA Think Tank, an Industrial Intelligence effort of our manufacturer’s community, e-mail: cesar.ponce@wdfservices.com

December of 2015

We salute AMPIP new Chairman, Pablo Charvel of Calafia Industrial Park in Mexicali.

Years ago we held a conversation with Pablo, “I’m interested in developing an industrial park” he share with us, so we provided our humble advice, never forget.

Today he is the chairman of AMPIP (Mexico’s Industrial Park Association) due to his professional skills and ethical attitude!

Congratulations Pablo, your leadership in our developing trade will be most positive, no doubt!

Suerte!

Team PIMSA

PDF

PIMSA and our entire team would like to thank WDF President, Cesar Ponce, for his effort and time in our Think Tank as part of our Industrial Intelligence Initiative; building a bridge to improve our industrial community.

Cesar is one of our best and brightest.

Please accept this present as a token of our appreciation.

Gracias Cesar, boundless capacity!

2016: VISION WITH STRENGTH!

This morning had an early meeting with members of our Industrial Intelligence Think Tank Group with ZGlobal Energy’s Ramon Gonzalez, a young executive of this Solar Energy Company.

Liked his phrase “longevity is the key”, I relate this to PIMSA’s “VISION WITH STRENGTH” as this coming 2016 turns 50 years of servicing manufacturers from all over the Globe.

PIMSA, means with passion and vision to continue in 2016 to complement our present Tenants with their continuous expansions and to guide World Manufacturers into a Soft Landing Process of establishing their operations here, with a solid and ethical Industrial Park.

Yes we could cut corners in setting up manufacturing facilities, but it is our experience of more than 49 years that a successful and profitable operation is a result of meeting those intangibles and Mexico’s procedures, staying away from a “no problem” approach or under table practices.

Longevity means success, we have done well in past years with our Tenants, of course there is always room for improvement and 2016 will be a good year, a year to expand and why not to reinvent in some areas.

For those seeking good production, competitive cost and young aggressive people, PIMSA has the experience and longevity!

From the desk,

Xavier Rivas

VP Business Development

PDF

Tradition and climate usually dictate what grows where in the wine world. Napa is Cabernet country because the climate, by and large, is amenable to ripening the grapes. The same can be said for Nebbiolo in Piemonte, Chardonnay in Chablis, Syrah in Hermitage.

Winemakers in this emergent wine region seem game to try almost anything, whether oddball varieties or anomalous blends. While this makes the region’s identity somewhat fluid, it also makes Baja one of the more unpredictable wine regions in the Western Hemisphere.

Mexico is home to the oldest winemaking traditions in North America. Hernando Cortes, the Spanish conquistador, was said to have requested grapevines from his mother country as early as 1521. Grapes were established in 1707 on the Baja peninsula, whose similarity to the Mediterranean was recognized early, with the Pacific helping to modulate intense desert conditions.

By the mid-1970s the country’s largest producers, L.A. Cetto and Casa Pedro Domecq, had extensive operations to produce cheap, commercial wines, primarily in the Guadalupe Valley northeast of Ensenada, an ancient seabed lined by low-slung mountains. With the aid of irrigation, the valley’s arid climate and mostly boundless sunshine have made it an agricultural engine not just for wine but for the produce that supplies raw material for Baja Med cuisine — the farm-and-sea-to-table efforts of Javier Plascencia and Miguel Angel Guerrero, to name just two of the chefs who have reinvigorated the Baja dining scene.

An influx of winemaking talent has gone hand in hand with the region’s culinary adventures, helped by the outreach efforts of Hugo d’Acosta, a French-trained wine grower who in 2004 established a hands-on wine school known as La Escuelita in El Porvenir. To date, more than 300 students have passed through its working cellars, and many have gone on to found or to work at wineries in the area. In 20 years, the number of wineries in the Guadalupe Valley has gone from a handful to more than 80.

Elsewhere, all bets are off. Where else do you find Cabernet blended with Nebbiolo or Grenache? Or Sauvignon Blanc and Chardonnay inhabiting the same bottle, to say nothing of Viognier, from the northern Rhône, and Fiano from southern Italy? How is Nebbiolo so weirdly plush and vibrant in Baja, for example, when it’s so grippy and lean in Piemonte?

“It has a richness here that it doesn’t achieve in Italy,” said Paolo Paolini, a Tuscan expat who founded the Villa Montefiore winery in the Guadalupe Valley and has imported a dozen Italian varieties. “You get full ripeness here, where in Italy, that’s sometimes difficult. The skins get darker and take on more anthocyans” — the stuff in a red grape that lends flavor, color and intensity.

The other great issue for the region is perhaps more existential. With no appellation laws and no holds barred on experimentation, to date no one wine style has emerged to help clarify a regional identity. But Magoni, who has worked 50 harvests there and is still planting experimental plots, seems content not to rush into anything.

“We’re still so young,” said Magoni. “We still don’t know. With some varieties, it will be years before we see their true potential.”

Source: LA Times

December 2015

Congratulations to Grupo Prodensa, for 30 years of Guiding International Manufacturers in Mexico.

We in PIMSA remember the beginnings, today Prodensa is a successful and most professional provider of Support Services for Manufacturers in Mexico.

This bottle of Baja California wine will be an opportunity to toast for your Prodensa’s continue success.

Special thanks to Marco Kuljacha and team.

Salud!